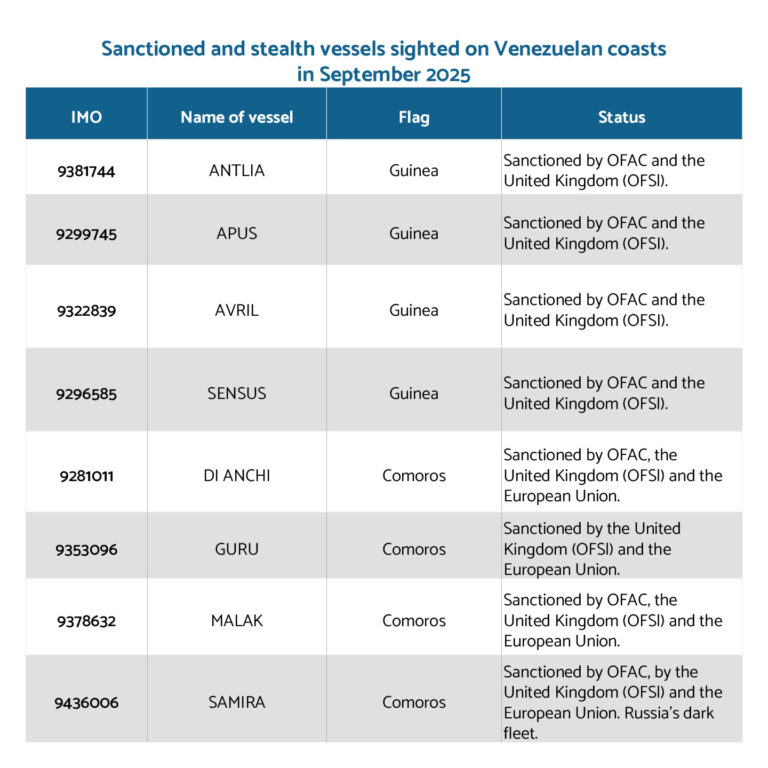

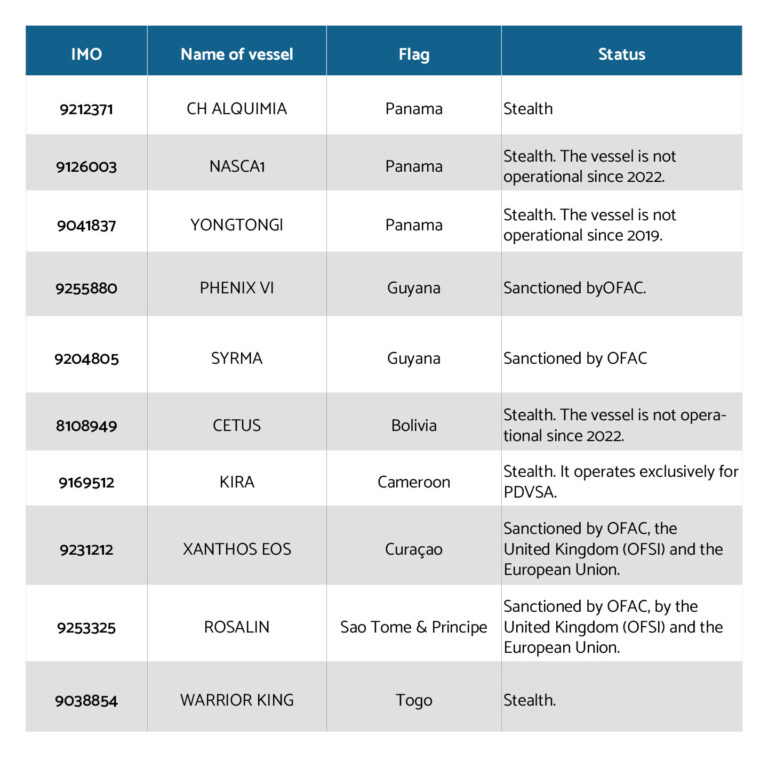

A total of 12 vessels sanctioned by United States, United Kingdom and the European Union were sighted. There were also 6 stealth boats and 29 vessels with their AIS signal switched off.

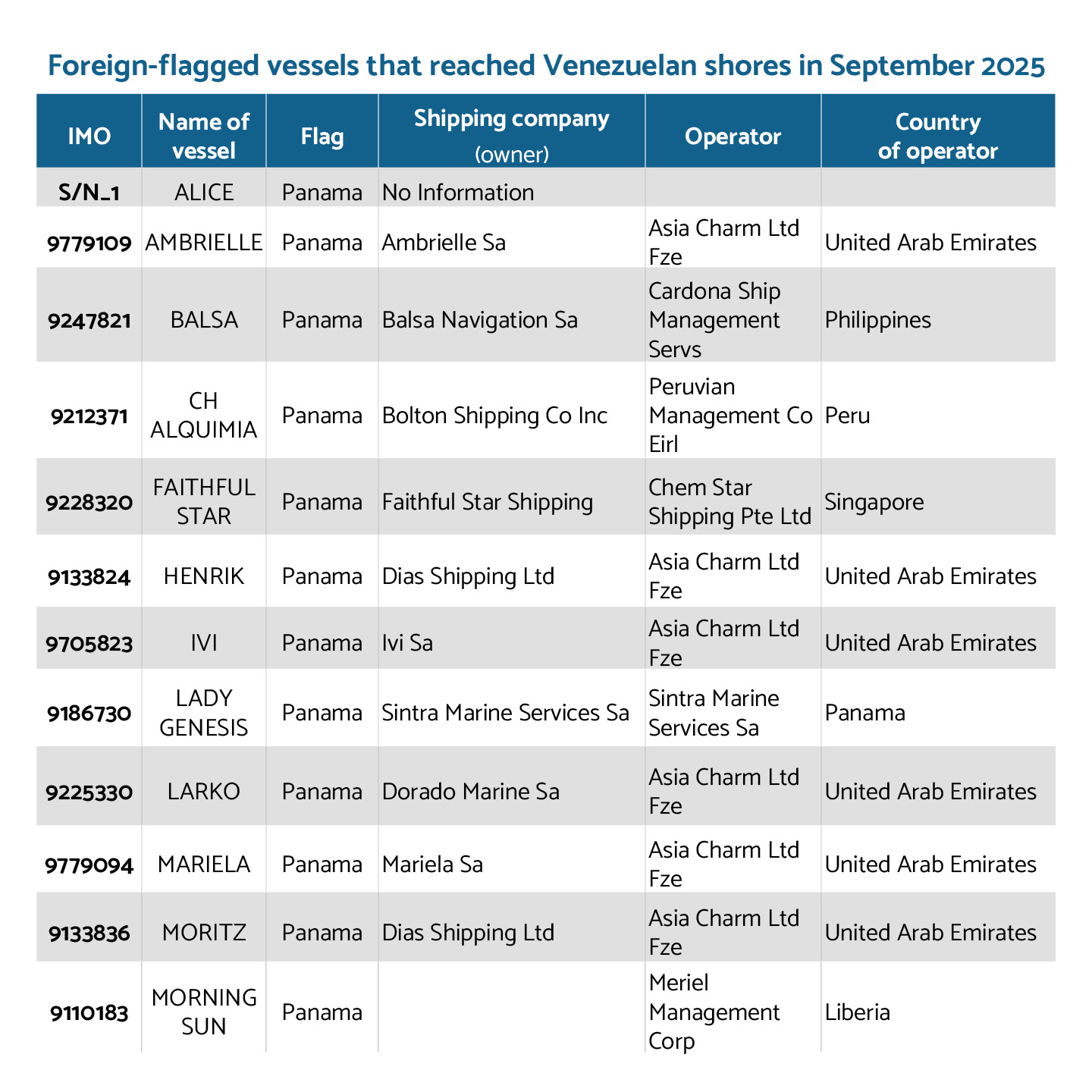

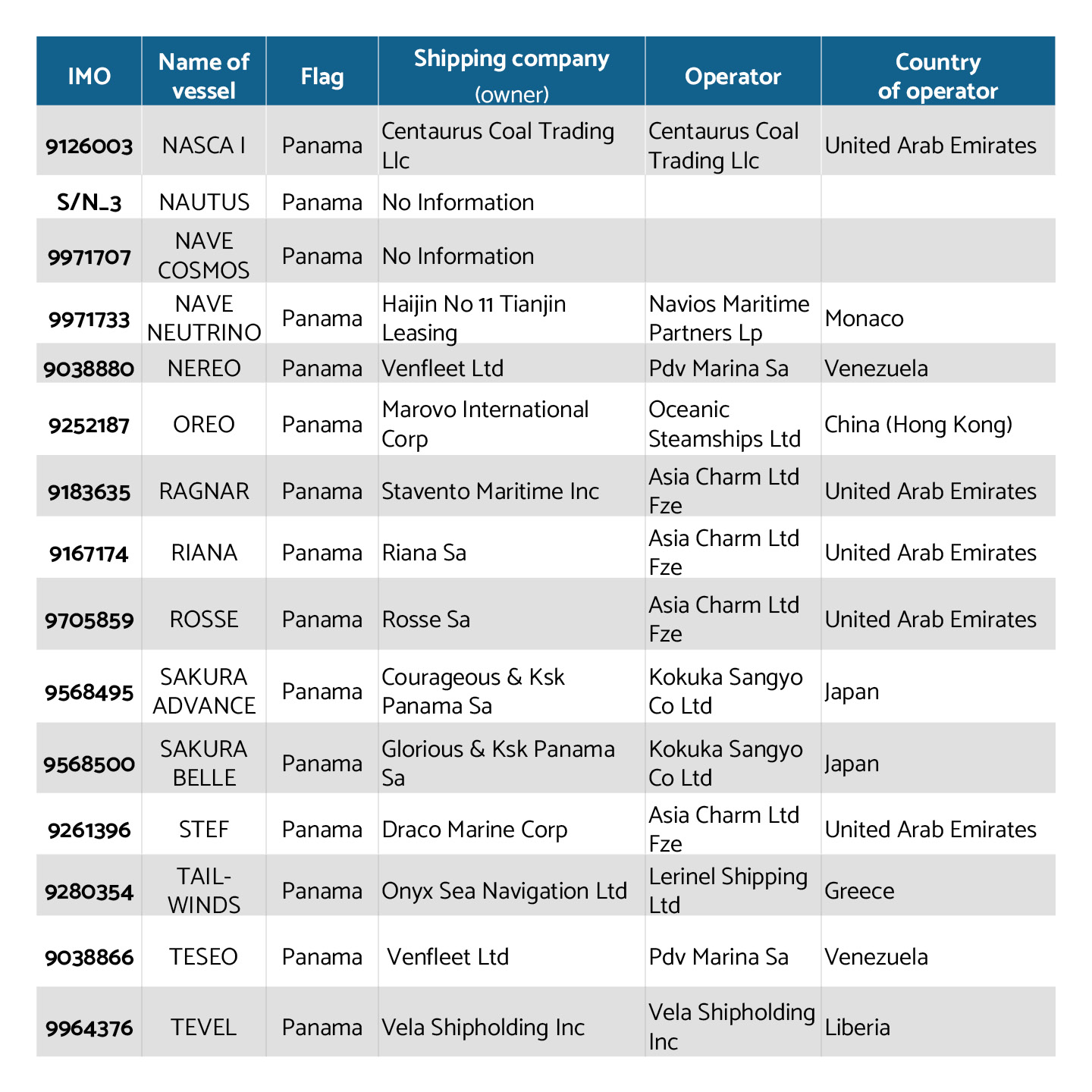

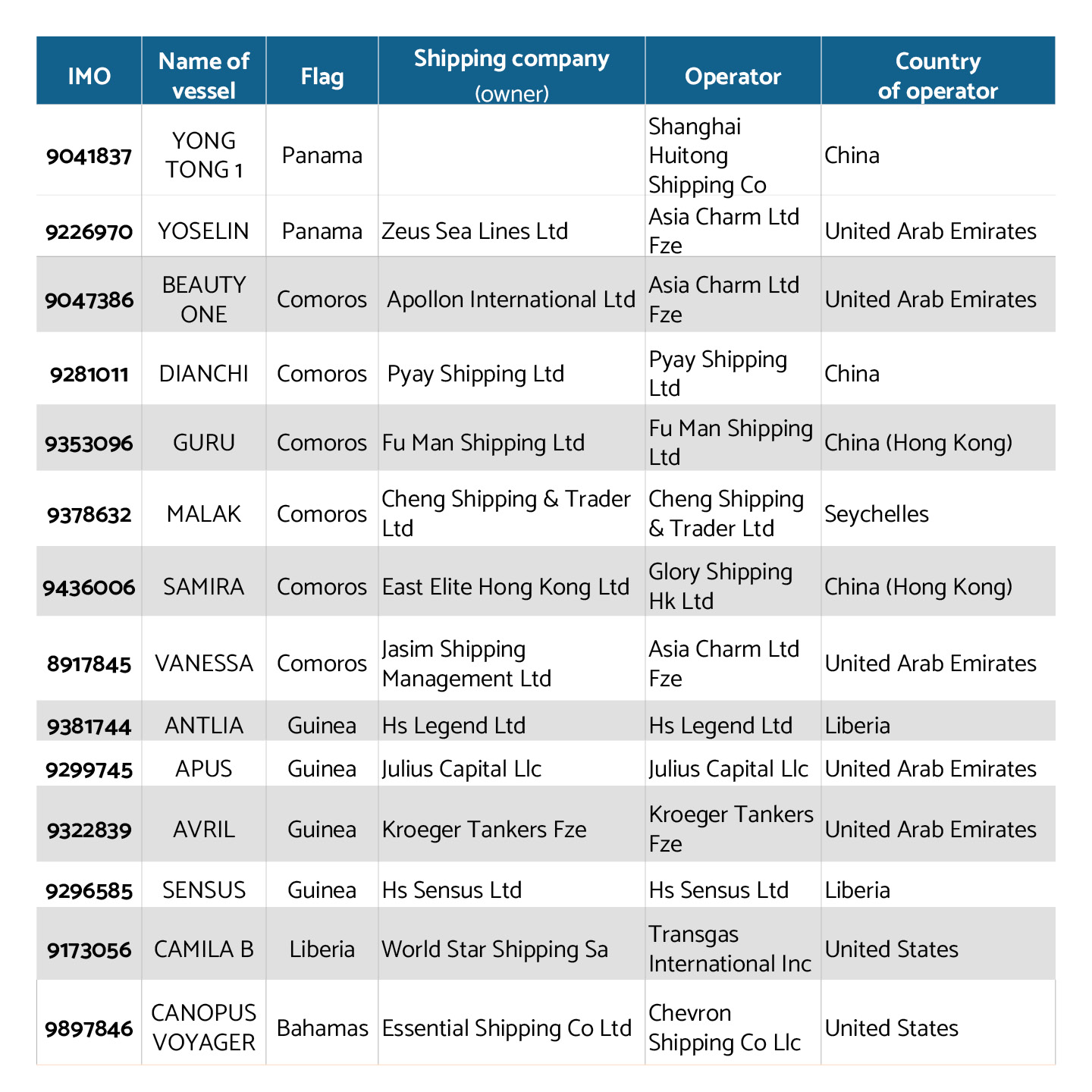

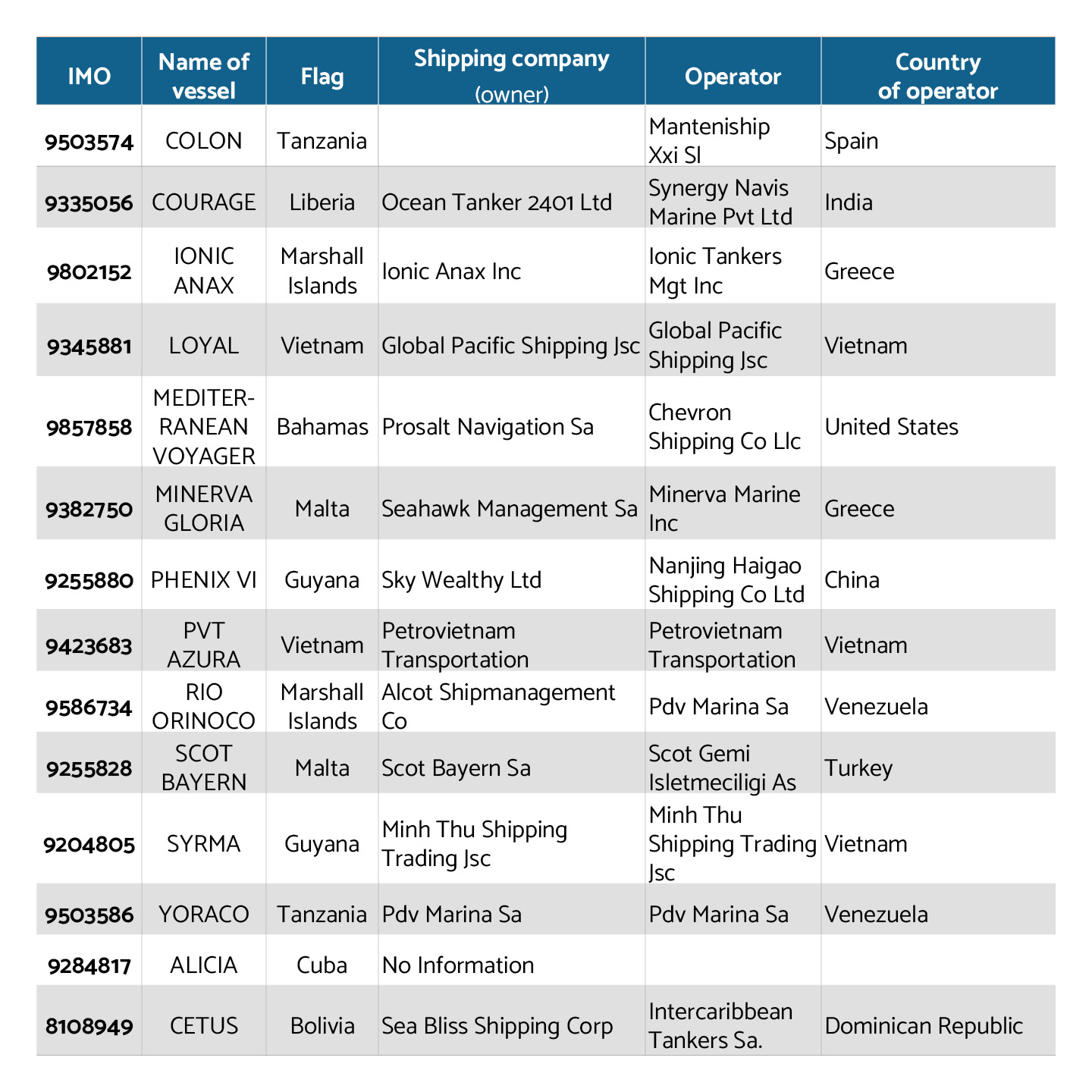

Transparencia Venezuela, September 30, 2025. Of the total of 110 tankers detected in Transparencia Venezuela’s monitoring of ports in Venezuelan territorial waters in September, at least 47 have an irregular status and 12 are sanctioned by the Office of Foreign Assets Control (OFAC) of the United States Department of the Treasury, the UK’s Office of Financial Sanctions Implementation (OFSI), and the European Union. The operating shipping companies are based in China, Vietnam, Liberia, the United Arab Emirates (UAE), or the Seychelles.

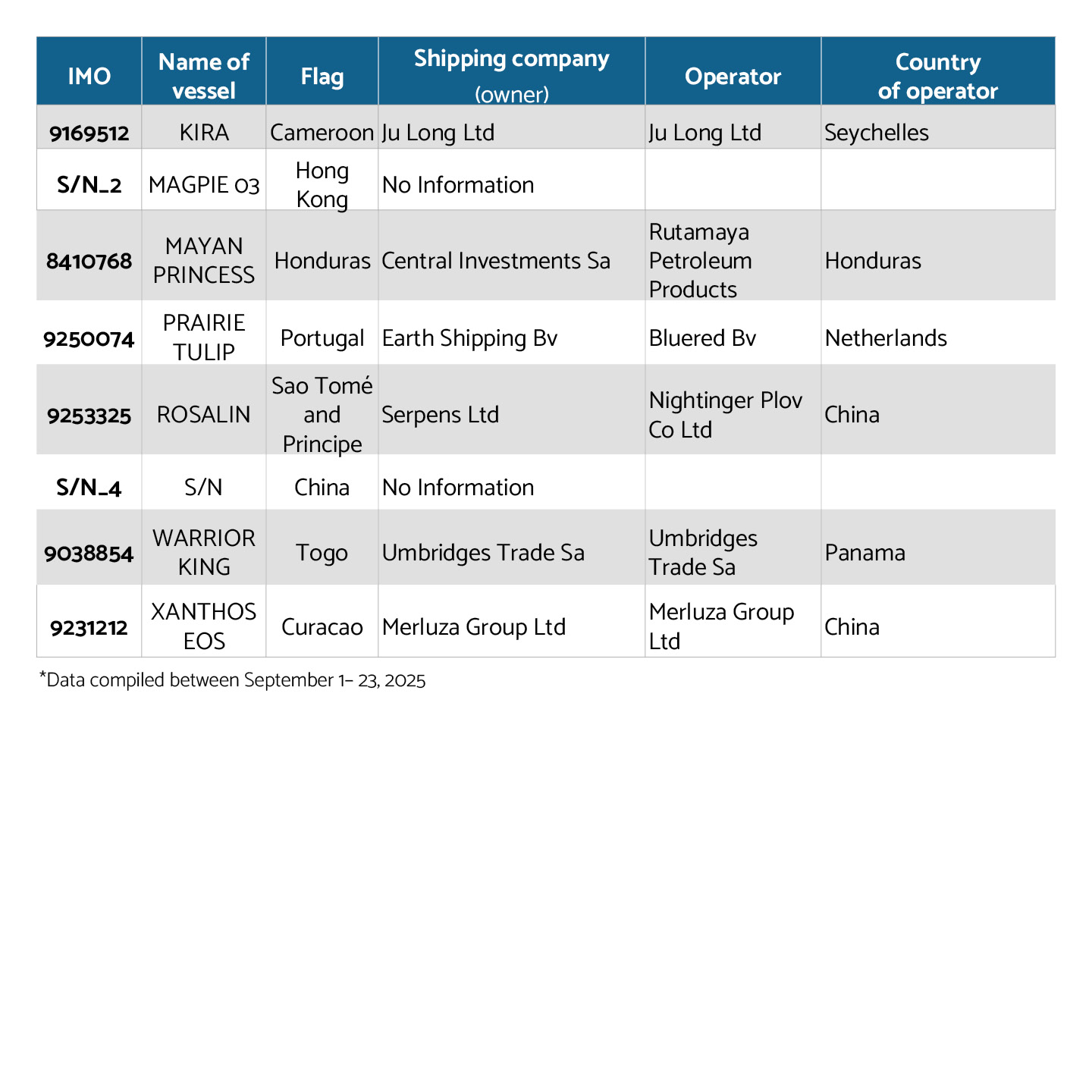

Similarly, the presence of six vessels internationally classified as stealth ships was confirmed, including the XANTHOS EOS, flying the Curaçao flag, and the SAMIRA, registered in the Comoros, originating from Russia. The other 29 vessels kept their mandatory tracking signals—AIS or automatic identification system—completely turned off.

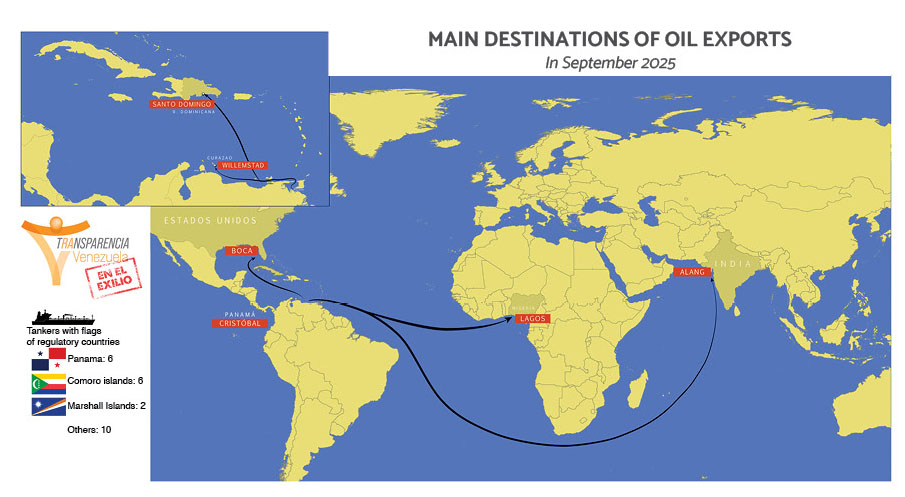

Compared to the previous two months, 52 vessels sighted in September had already been detected off the Venezuelan coast, and 11 oil, gas, derivatives, and chemical tankers are new sightings in this period, meaning that there were 63 foreign-flagged vessels identified, not including the 29 without signals or in dark mode. Of the total of 110 tankers in Venezuelan territorial waters in September, 18 ships are flying the Venezuelan flag.

An analysis of the overall data for the three months (July, August, and September) revealed that 10 foreign-flagged vessels are exclusively serving PDV Marina—sailing between Venezuela’s eight oil ports—most of them registered in Panama and the Comoros by shipping companies from the United Arab Emirates.

UAE companies continue to operate freely

Four companies based in the United Arab Emirates operate 16 of the monitored tankers transporting Venezuelan crude oil. Asia Charm Limited FTZ alone, created in 2019, is responsible for 13 ships. The company has been the focus of international investigative journalism, with Reuters singling it out, along with two other companies (Issa Shipping FZE and Muhit Maritime), as shippers involved in the transport of Venezuelan crude oil to evade U.S. sanctions in 2020. The authorities in the United Arab Emirates indicated at the time that they were conducting an investigation into the companies, with no known consequences for Asia Charm, despite its confirmed involvement.

The other three vessels out of the 16 operated from the United Arab Emirates are managed by different shipping companies, but are equally compromised because two ships are sanctioned (Apus from Julius Capital and Avril from Kroeger Tankers) and one is a stealth vessel (Nasca I from Centaurus Coal Trading).

Regulatory havens facilitating sanctions evasion

As in previous months, continuous monitoring confirmed that Venezuelan crude oil transport operations are carried out to a very significant extent by vessels registered in regulatory havens.

Guinea (4), Comoros (4), and Panama (3) top the list of tankers flying flags of convenience to evade oil sanctions.

The opaque oil trade, with its high risk of corruption, is becoming entrenched

The resumption of Chevron’s operations in Venezuela and the resulting flow of oil to the United States was confirmed by the tracking of vessels in August (6) and September (6).

However, the terms of the current oil license are well below export levels under the previous license due to Chevron’s commitment to pay its tax obligations in Venezuela in kind, i.e., with oil, according to Reuters.

Thus, PDVSA will maintain most of its exports in Asian markets with opaque intermediaries and high risks of financial losses due to non-compliance, corruption, and environmental damage.

Compounding these risks is the upturn in the use of cryptocurrencies in oil trading transactions, reflected in the also growing allocation of crypto assets in the official exchange market, replacing the dollar. This is happening without proper information to the public about this policy and without a careful assessment of the possible economic or other impacts.